35+ are mortgage points tax deductible

Web Deduction on interest paid on a housing loan A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on. Homeowners who bought houses before.

Ing International Survey Homes And Mortgages 2017 Rent Vs Own

Web Are mortgage points tax-deductible.

. Discover Helpful Information And Resources On Taxes From AARP. With a 30-year mortgage you deduct one-thirtieth of the cost of the points each year. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Start Today to File Your Return with HR Block. Is mortgage interest tax deductible. Here are the specifics.

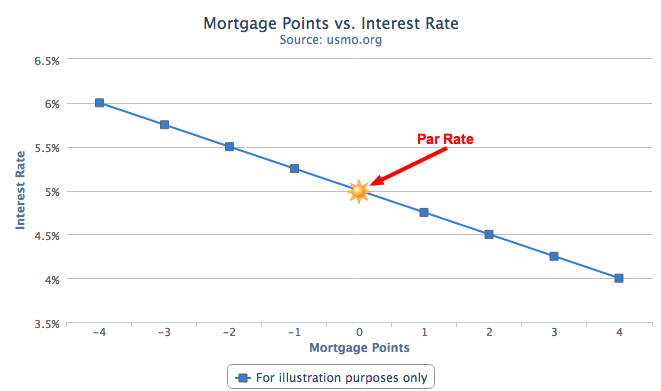

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. You used the mortgage points to buy or build your main. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage.

The mortgage is used to buy build or improve the home and the. Web Generally you cannot deduct the full amount of mortgage points in the year paid as they are considered prepaid interest and must be deducted equally through the. Ad Learn How Simple Filing Taxes Can Be.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Yes you can deduct points for your main home if all of the following conditions apply. Web Each point the borrower buys costs 1 percent of the mortgage amount.

Web Mortgage points also known as discount points are an option for buyers to pay an upfront fee at closing to buy down the interest rate on a loan. So one point on a 300000 mortgage would cost 3000. Web Here is an overview of which mortgage costs might be tax deductible for you in 2023.

If the amount you borrow to buy your home exceeds 750000 million. Web Up to 96 cash back You cant deduct mortgage points if the lender withheld the amount of the points from the loan proceeds. Current IRS rules allow many homeowners to.

To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Usually your lender will send you.

In effect mortgage points are a. Web The IRS allows homeowners to deduct points as mortgage interest when certain conditions are met. But not as a lump sum.

Discover How HR Block Makes It Easier to File Your Way. Web Mortgage points are considered. The term points is a common.

Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040. Deductions reduce your taxable income for the year which.

File Online or In-Person Today.

Understanding Mortgage Points U S Mortgage Calculator

Loan Origination Software Prices Reviews Capterra New Zealand 2023

Home Mortgage Loan Interest Payments Points Deduction

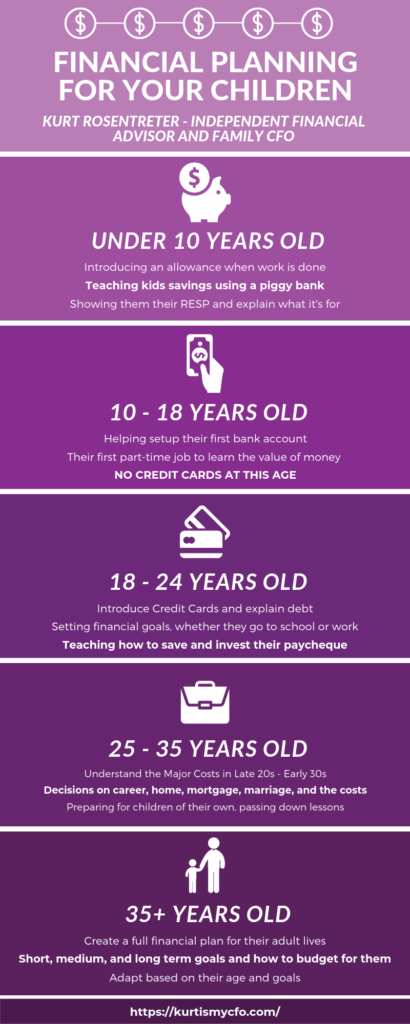

Financial Planning For Your Children At Any Stage Of Life

Adjustable Rate Mortgage What Is It And How Does It Work

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Mortgage Points What Are They And Are They Worth It

Shopify Taxes 5 Must Know Deductions To Maximize Profits Reconvert

Tax Credits For Homeowners Homeowner Tax Deductions Explained

Maximum Mortgage Tax Deduction Benefit Depends On Income

Top 35 Distribution Kpis And Metric Examples For 2021 Reporting Insightsoftware

How To Deduct Mortgage Points On Your Taxes Smartasset

Discount Points Calculator How To Calculate Mortgage Points

Calculating The Home Mortgage Interest Deduction Hmid

Jul 5 2012 Herald Union By Advantipro Gmbh Issuu

Mortgage Points Deduction Itemized Deductions Houselogic

Anurag Yadav Auf Linkedin Careers Managementconsulting Education 58 Kommentare